salt tax cap explained

52 rows The SALT deduction allows you to deduct your payments for property. State and Local Tax SALT tax deduction cap explained.

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

164b6 added by the TCJA for tax years 2018 through 2025 limits the itemized deductions for personal property taxes state or local taxes foreign taxes and state and local sales taxes in lieu of state and local income taxes to 10000 per year 5000 if married filing a separate return the SALT cap.

. One obvious point of. The new SALT deduction allows taxpayers to deduct their sales tax state income tax and property tax up to an aggregate 10000 limit. 2 days agoSCOTUS swats away SALT cap challenge that limits tax deductions in New York Maryland Four states had challenged the 2017 limit on deductions of state and local taxes.

The SALT Deduction or State and Local Tax Deduction allows people to write off their local taxes from their income in federal taxes. Since the SALT cap was put into place however very high earners have. Tom WilliamsCQ-Roll Call Inc via Getty Images More On.

22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. Because of the limit however the taxpayers SALT deduction is only 10000. Now the SALT tax cap is set to expire in 2025.

Starting with the 2018 tax year the maximum SALT deduction available was 10000. In 2017 during the Trump Administration the Tax Cuts and Jobs Act TCJA raised the amount of the standard deduction. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments.

Beginning in 2018 the itemized deduction for state and local taxes paid will be capped at 10000 per return for single filers head of household filers and married taxpayers filing jointly. In 2019 the taxpayer receives a 750 refund of state income taxes paid in 2018 meaning the taxpayers actual 2018 state income tax liability was 6250 7000 paid minus 750 refund. Bloomberg Law -- The Supreme Court declined to review a New York-led constitutional challenge to the 10000 cap on state and local tax deductions imposed by Congress in the 2017 tax law.

Income taxes sales taxes personal property taxes and certain real property taxes are eligible for the SALT deduction 1. Homeowners who itemize deductions on their federal income tax returns have been able to deduct without limit New York State and NYC real estate taxes for decades. To help pay for that increase SALT deductions were capped at 10 000 per.

The Tax Cuts and Jobs Act TCJA capped it at 10000 per year consisting of property taxes plus state income or. Leaders are trying to decide whether to. For taxpayers living in states with very high income tax rates taxpayers lose big time.

The value of the SALT deduction as a percentage of adjusted gross income AGI tends to increase with a taxpayers income. With changes to the tax code enacted in the 2017 Tax Cuts and Jobs Act deductions were capped at 10000 starting on January 1 2018. 17 hours agoThe cap generally blocks taxpayers who itemize federal deductions from deducting more than 10000 per year for paid state and local taxes including property taxes and either income or sales taxes.

Unfortunately especially for higher income households the SALT deduction has been capped at 10000. 54 rows The Internal Revenue Service IRS has provided data on state and local taxes paid and deducted for tax year 2018 the first year the SALT cap went into effect. The tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction.

However many filers dont know. In the most basic terms the proposed changes to the SALT deduction would increase the deduction cap from 10000 to 72500 per year with the raised cap set to expire January 1 2032. The federal tax reform law passed on Dec.

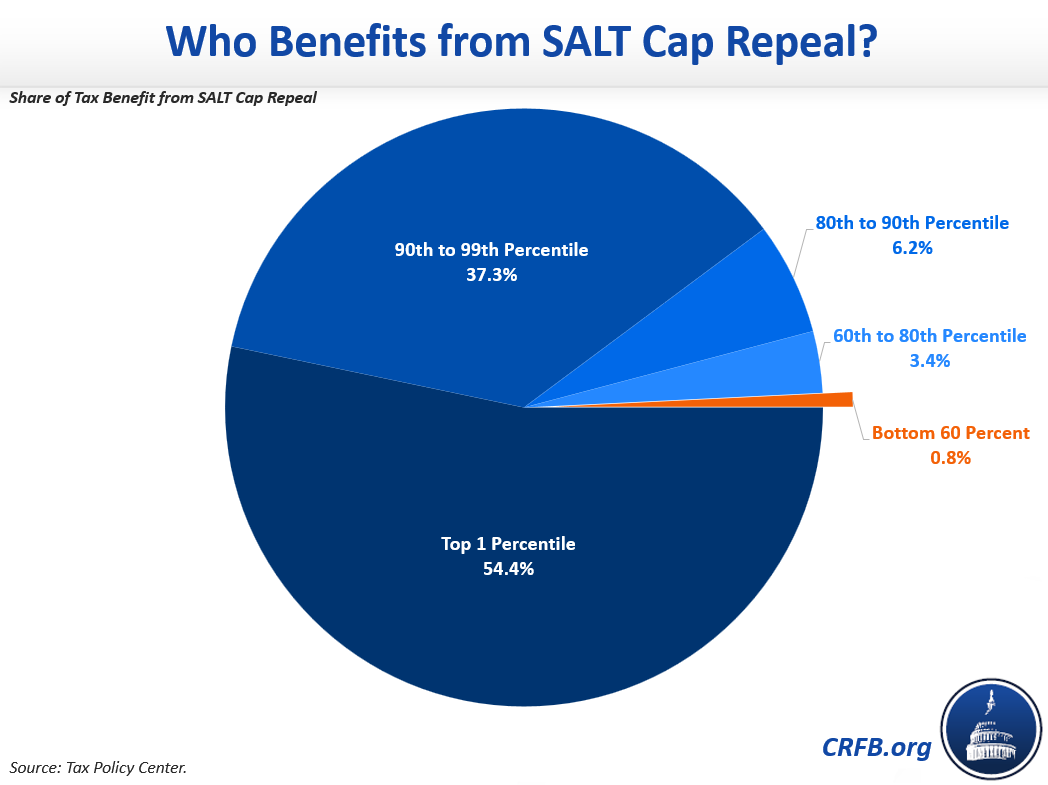

It is useful to compare the distributional impact of SALT cap repeal to other tax policies or packages. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns. Lifting the SALT cap much more pro-rich than Trumps tax bill.

2 days agoThe SALT cap blocks taxpayers from deducting more than 10000 per year in their state and local taxes when itemizing federal deductions. The SALT Deduction is currently capped at 10000 so if youre paying more than that in local taxes you wont. The 10000 limit on SALT deductions has a significant measurable revenue impact affecting the federal budget.

House Democrats 175 trillion spending package boosts the limit on the federal deduction for state and local taxes known as SALT to 80000 through 2030. Prior to the limits enactment the cost in. This limit on state and local tax is often abbreviated to the SALT deduction cap and was temporarily set at 10000 for single and married filers and 5000 for married couples filing separately.

In 2018 Trump placed a cap on the SALT deduction in order to recover revenue lost from various tax cuts.

Salt Deduction Resources Committee For A Responsible Federal Budget

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

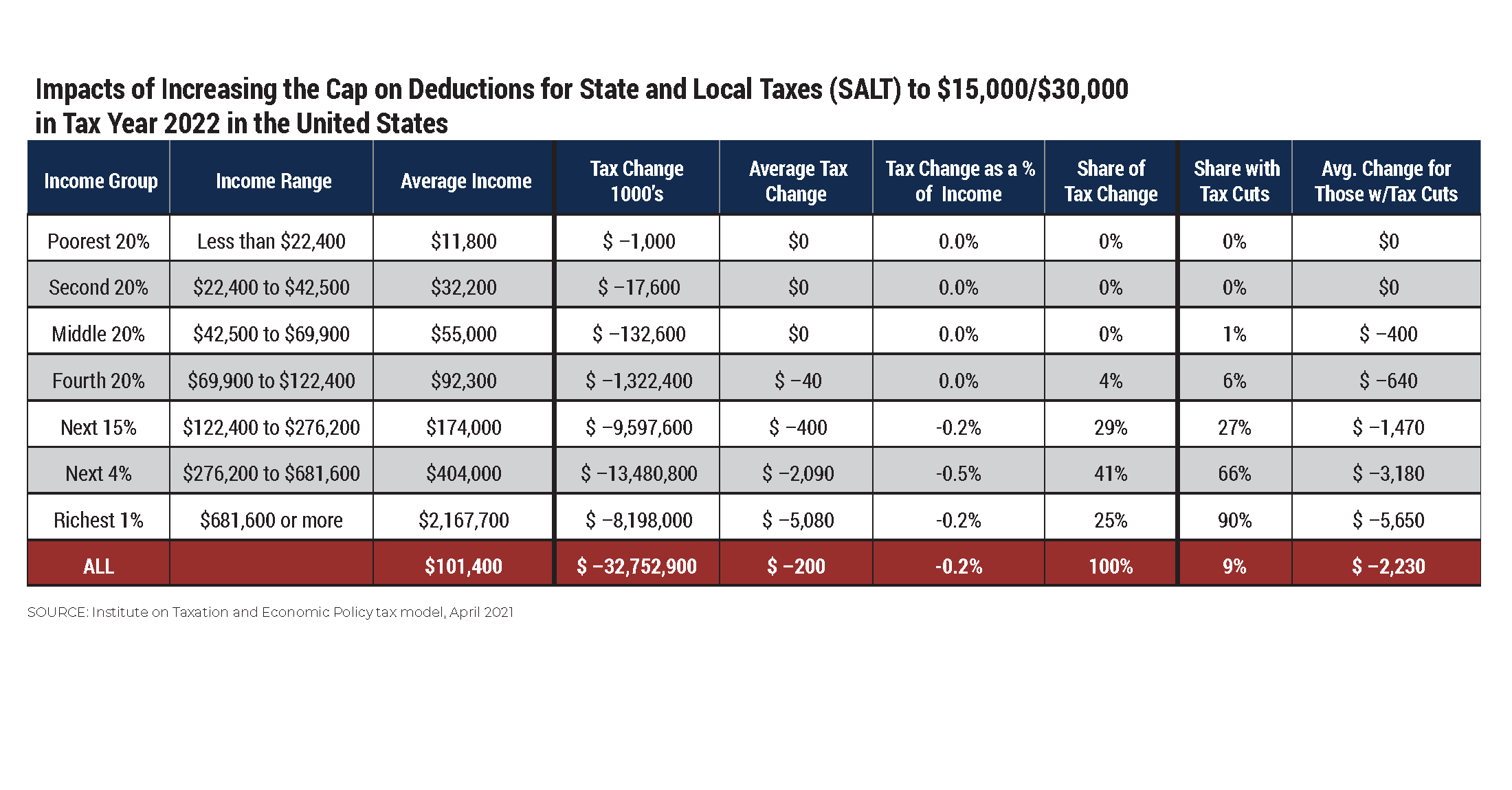

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

State And Local Tax Salt Deduction Salt Deduction Taxedu

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Vintage 90s Salt Lake Buzz Minor League Milb Team Minnesota Twins Bees Delong Wool Fitted Hat Baseball Cap 7 1 2 Mad In 2022 How To Wash Hats Fitted Hats Baseball Hats

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

The Other Salt Cap Workaround Accountants Steer Clients Toward Private K 12 Voucher Tax Credits Itep

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

How Does The Deduction For State And Local Taxes Work Tax Policy Center

The Salt Cap Overview And Analysis Everycrsreport Com

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress