salt tax cap explained

1 day agoKey Points. TCJA and the 10000 SALT Cap.

2fish Deep Water Ca Deep Water Luke Deep

The deduction of state and local tax payments known as SALT from federal income taxes has been a subject of debate among economists and policymakers over the past.

. About 10 percent of tax filers with incomes less than 50000 claimed the SALT deduction in 2014 compared with about 81 percent of tax filers with incomes exceeding. That limit applies to all. In 2017 during the Trump Administration the Tax Cuts and Jobs Act TCJA raised the amount of the standard deduction.

Background on the Tax Cuts and Jobs Act TCJA 10000 SALT Cap for Minnesota Businesses and What Has Changed In 2017 the TCJA capped the itemized deduction for SALT at 10000. Five House Democrats are still fighting for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT. For anyone that itemizes their personal deductions they can deduct 10000 with the SALT deduction or 5000 for married people filing separately.

In 2019 the taxpayer receives a 750 refund of state income taxes paid in 2018 meaning the taxpayers actual 2018 state income tax liability was 6250 7000 paid minus 750 refund. The Tax Cuts and Jobs Act. The federal tax reform law passed on Dec.

This deduction is called the SALT deduction and it allowed taxpayers to reduce the amount of federal tax owed by deducting money theyd already spent on state property taxes. Section 164 of the Internal Revenue Code IRC generally allows a deduction for state and local taxes paid. However for individual taxpayers who itemize their.

The GOP tax bill explained. Income taxes sales taxes personal property taxes and certain real property taxes are eligible for the SALT deduction 1. While the Tax Cuts and Jobs Act placed a 10000 cap on the SALT deduction its only temporary.

Homeowners who itemize deductions on their federal income tax returns have been able to deduct without limit. The SALT Deduction is currently capped at 10000 so if youre paying more than that in local taxes you wont be able to remove that from your reported income. Making sense of the new cap on state tax deductions.

This limit on state and local tax is often abbreviated to the SALT deduction cap and was temporarily set at 10000 for single and married filers and 5000 for married couples filing separately. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns. The value of the.

House Democrats 175 trillion spending package boosts the limit on the federal deduction for state and local taxes known as SALT to 80000 through 2030. State and Local Tax SALT tax deduction cap explained. The tax plan signed by President Trump.

224 PM ET. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. The Tax Cuts and Jobs Act which took effect in 2018 capped the maximum SALT deduction to 10000 5000 for married individuals filing separately.

The Internal Revenue Service IRS has provided data on state and local taxes paid and deducted for tax year 2018 the first year the SALT cap went into effect. To help pay for that increase SALT deductions were. 52 rows The SALT deduction allows you to deduct your payments for property.

More than 20 Democrats. The rich especially the very rich. By Kathryn Vasel KathrynVasel December 20 2017.

The cap applies to taxable years 2018 through 2025. The lawmakers are urging. Because of the limit however the taxpayers SALT deduction is only 10000.

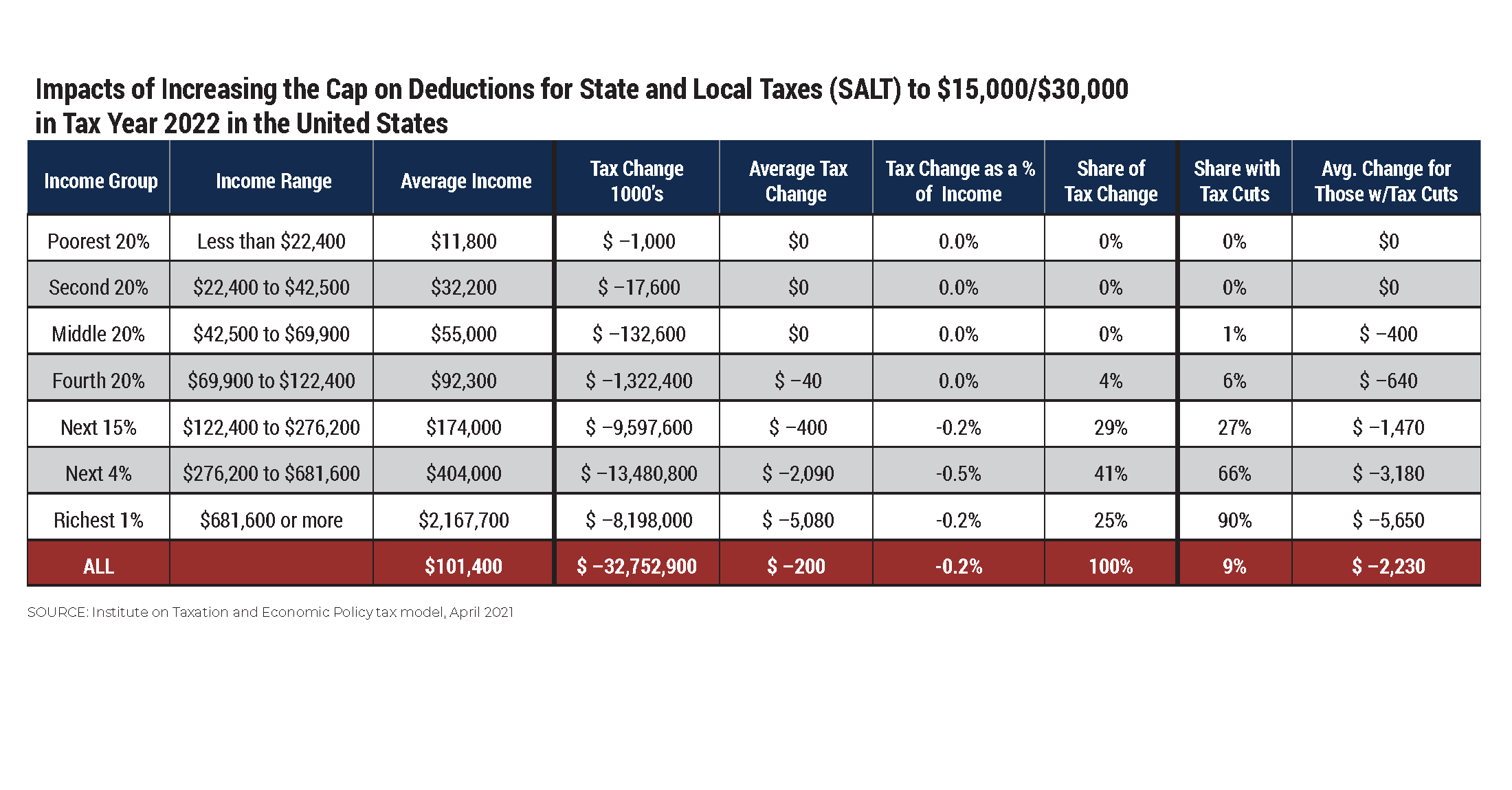

22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. Almost all 96 percent of the benefits of SALT cap repeal would go to the top quintile giving an average tax cut of 2640.

Vintage 90s Salt Lake Buzz Minor League Milb Team Minnesota Twins Bees Delong Wool Fitted Hat Baseball Cap 7 1 2 Mad In 2022 How To Wash Hats Fitted Hats Baseball Hats

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Understanding Salt Cap Workarounds Youtube

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Vintage Trucker Hat Snapback Hat Baseball Cap Akzo Salt Inc Mine Chemical Vintage Trucker Hats Trucker Hat Snapback Hats

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

The Other Salt Cap Workaround Accountants Steer Clients Toward Private K 12 Voucher Tax Credits Itep

How To Deduct State And Local Taxes Above Salt Cap

State And Local Tax Salt Deduction Salt Deduction Taxedu

Calls To End Salt Deduction Cap Threaten Passage Of Biden S Tax Plan